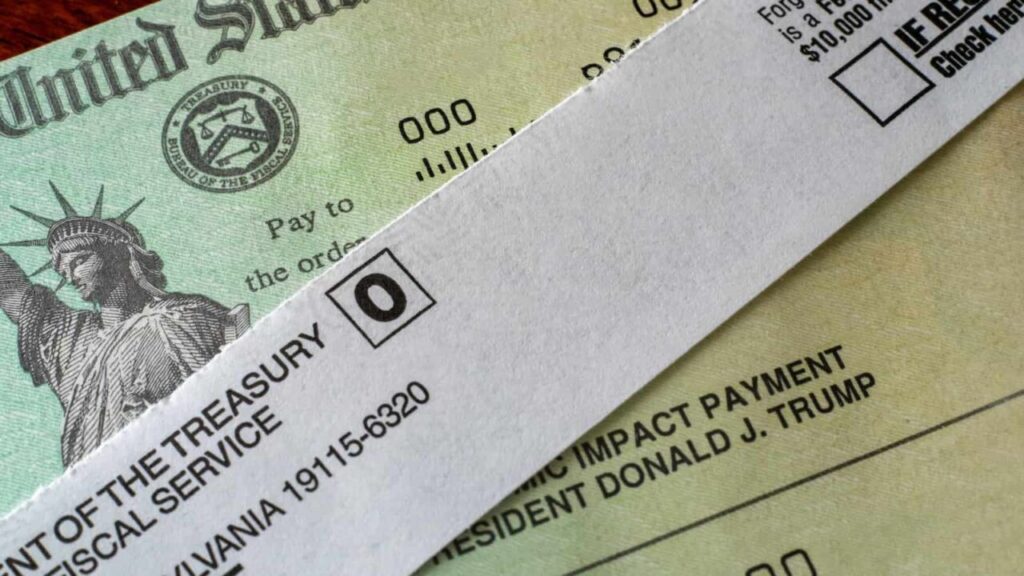

Contrary to some misleading online claims, there are no $1,400 monthly stimulus checks being distributed in 2025. However, millions of Americans who never received the third round of COVID-19 stimulus checks in 2021 may still be eligible for a one-time $1,400 payment, and the deadline to claim it is April 15, 2025.

This payment is part of the Recovery Rebate Credit (RRC), and it’s aimed specifically at individuals who didn’t receive the third Economic Impact Payment during the pandemic or didn’t file a 2021 tax return.

Who Is Eligible?

The IRS states that individuals who missed the third stimulus payment and did not file a tax return for 2021 are still eligible to claim the Recovery Rebate Credit by submitting a late return. Eligibility is based on income and filing status.

✅ Income Thresholds for Full Credit:

- Single filers: Full $1,400 credit if AGI was $75,000 or less

- Married couples filing jointly: Full $2,800 credit (plus dependents) if AGI was $150,000 or less

- Head of household: Full credit if AGI was $112,500 or less

The payment phases out entirely at:

- $80,000 for single filers

- $160,000 for married couples filing jointly

- $120,000 for heads of household

In addition, those with qualifying dependents can receive an additional $1,400 per dependent.

Why Are Payments Happening in 2025?

This isn’t a new stimulus program. The IRS has identified that over 1 million taxpayers never filed a 2021 tax return, which is required to claim the third round of stimulus checks issued in 2021.

To help close this gap, the IRS announced in January 2025 that it was automatically issuing payments to individuals who qualified for the credit based on information the agency already had. However, many eligible individuals must take action themselves by filing their 2021 return.

“We don’t want people to miss out on this payment, especially those who might qualify but haven’t filed a 2021 return,” said IRS Commissioner Danny Werfel.

How to Claim the $1,400 Recovery Rebate

To receive the credit, eligible individuals must file a 2021 federal income tax return by April 15, 2025. Even if you had no income or typically don’t file taxes, the IRS requires you to file to receive the payment.

Filing Options:

- File using IRS Free File if income was $73,000 or less in 2021

➤ https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free - Download prior year forms and mail them to the IRS

➤ https://www.irs.gov/forms-pubs/about-form-1040 - Use authorized tax software or seek help from Volunteer Income Tax Assistance (VITA) programs

➤ https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

When Will You Receive the Payment?

If you file your 2021 return by the April 15, 2025 deadline and qualify for the Recovery Rebate Credit, the IRS typically processes the return within 21 days (if filed electronically) and sends payments shortly after.

Those who qualified based on existing records may have already received the payment automatically in early 2025. But for those who haven’t, filing is essential.

Beware of Misinformation

Many social media posts and unofficial sources have referred to “$1,400 monthly stimulus checks” or “new stimulus in 2025.” These are inaccurate claims. The U.S. government is not issuing monthly stimulus checks in 2025.

Final Deadline: April 15, 2025

If you think you’re eligible, don’t delay. After April 15, 2025, you will no longer be able to claim the 2021 Recovery Rebate Credit. This is your last opportunity to receive the $1,400 COVID relief payment if you missed it during the initial rollout.

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.